The Pin Bar is a popular forex trading strategy that helps traders identify potential reversals in the market. This strategy relies on the formation of a specific candlestick pattern called the “Pin Bar,” which indicates a possible change in market direction. In this article, we’ll delve into this strategy, its components, how to identify it, and how to effectively use it in your trading.

What is a Pin Bar?

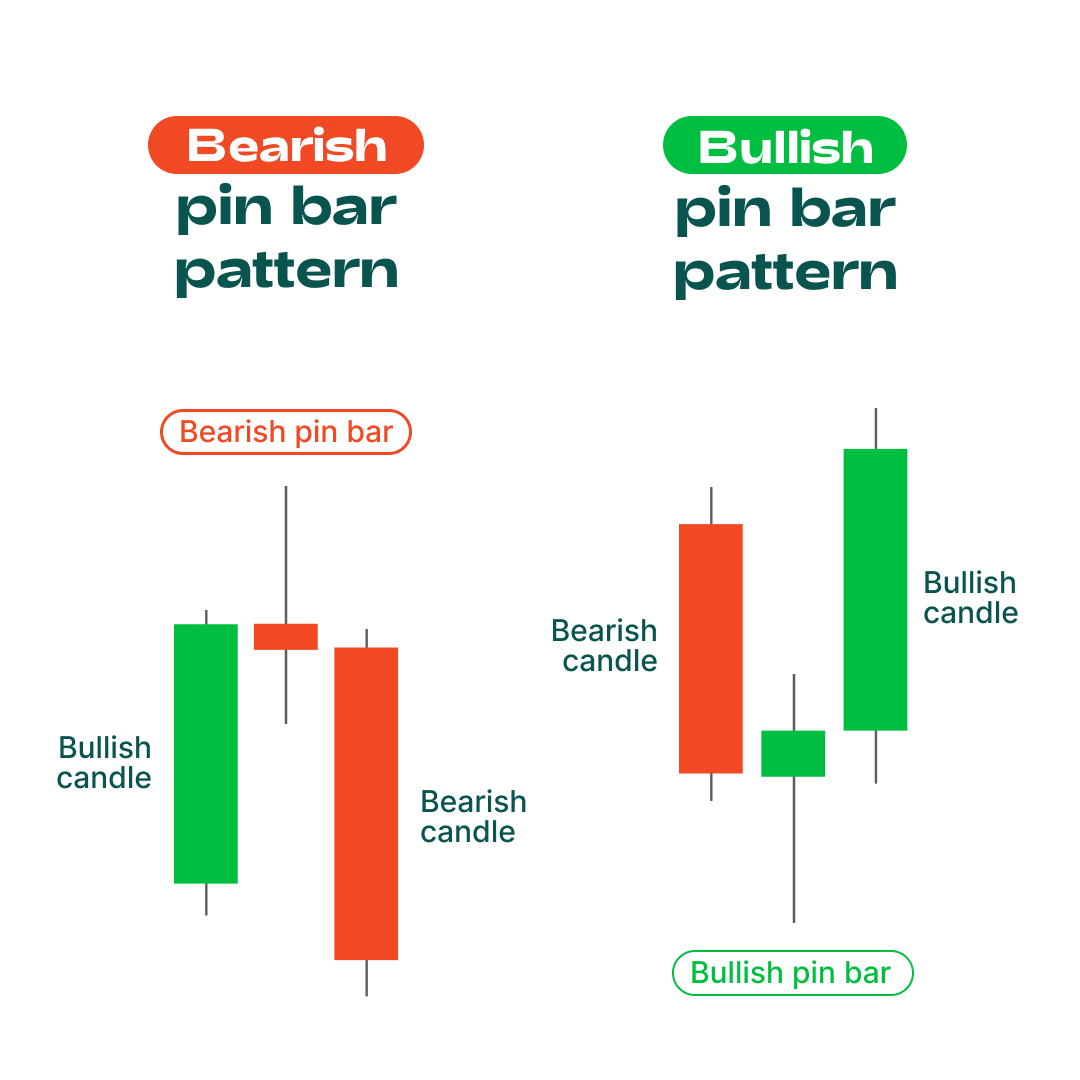

A Pin Bar, short for “Pinocchio Bar,” is a candlestick pattern that signals a potential reversal in the market. It consists of a small body and a long wick (or shadow), which shows rejection of a certain price level. The long wick represents the price movement in one direction, while the small body indicates that the price was pushed back, signaling a reversal.

Characteristics of a Pin Bar

Long Wick

The most prominent feature of it is its long wick, which should be at least two-thirds of the total candlestick length. The wick represents the area where the price was rejected.

Small Body

The body of a Pin Bar is small, indicating that the open and close prices are close to each other. The color of the body is less important than its size relative to the wick.

Wick Placement

A bullish Bar has a long lower wick and a small upper body, signaling a potential upward reversal. Conversely, a bearish Bar has a long upper wick and a small lower body, indicating a potential downward reversal.

How to Identify a Pin Bar

Trend Identification

The first step in using the Pin Bar strategy is to identify the current market trend. Pin Bars are more effective when they appear at the end of a trend or at key support and resistance levels.

Confirmation of Rejection

A valid Pin Bar must show clear rejection of a price level. This rejection is evidenced by the long wick, indicating that the market tested a level but failed to maintain that price.

Context and Location

The location of the Bar is crucial. Look for Pin Bars at significant support or resistance levels, trend lines, or Fibonacci retracement levels. The context in which the Pin Bar appears can greatly enhance its reliability.

Using the Pin Bar Strategy

Entry Points

To enter a trade based on a Pin Bar, wait for the formation of the Pin Bar and confirmation of the reversal. For a bullish Pin Bar, enter a long position above the high of the Pin Bar. For a bearish Pin Bar, enter a short position below the low of the Pin Bar.

Stop-Loss Placement

Place the stop-loss order just beyond the wick of the Pin Bar to protect against false signals. For a bullish Pin Bar, the stop-loss should be below the low of the wick. For a bearish Pin Bar, the stop-loss should be above the high of the wick.

Take-Profit Targets

Set take-profit targets based on key support and resistance levels, previous highs and lows, or Fibonacci extension levels. Consider a risk-reward ratio of at least 1:2 to ensure that potential profits outweigh the risks.

Advantages of the Pin Bar Strategy

Simplicity

This strategy is straightforward and easy to understand, making it suitable for traders of all experience levels.

High Probability

When combined with proper market context and trend analysis, it can provide high-probability trading opportunities.

Versatility

This strategy can be applied across different time frames and market conditions, making it a versatile tool for forex traders.

Limitations of this Strategy

False Signals

Like any trading strategy, this strategy is not immune to false signals. It’s essential to use additional confirmation tools and risk management techniques to mitigate this risk.

Requires Patience

Successful implementation of this strategy requires patience and discipline. Traders must wait for clear Pin Bar formations and confirmation of reversals before entering trades.

Combining Pin Bars with Other Indicators

Moving Averages

Combining Bars with moving averages can help confirm trends and reversals. Use moving averages to identify the overall trend and look for Pin Bars that align with the trend direction.

RSI (Relative Strength Index)

The RSI can be used to confirm overbought or oversold conditions. Look for bullish Pin Bars in oversold regions and bearish Pin Bars in overbought regions to increase the probability of successful trades.

Bollinger Bands

Bollinger Bands can help identify potential reversal points. Look for Pin Bars that form at the outer bands, indicating that the price has reached an extreme level and may reverse.

Conclusion

This strategy is a powerful tool for forex traders seeking to capitalize on market reversals. By understanding the characteristics of Pin Bars, how to identify them, and how to use them effectively, traders can improve their trading performance. Remember to use additional confirmation tools and practice sound risk management to enhance the success of the Pin Bar strategy.